The Importance Of ESG

Environment + Social + Governance

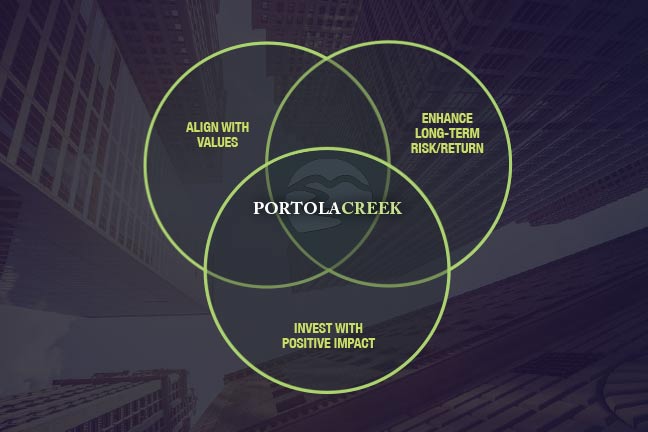

Portola Creek is amongst an increasing number of institutional investors integrating ESG criteria into their investment strategies. But here’s the challenge: Simply excluding every objectionable sector or choosing only high ESG scorers reduces the universe of investable stocks by half. So how do we implement ESG principles without sacrificing diversification or abandoning efforts to improve corporate conduct?

"Our identification of a company’s declining Governance score over time has been an effective sell signal before a significant event occurs."

Environment + Social + Governance

We accomplish this in three ways. First, we compare a stock’s ESG rating to other companies in their respective sector. It would not be especially useful to compare an energy company’s ESG score to that of a technology company for example. Secondly, monitoring the momentum of a company’s ESG score helps us identify early signs of a business that is improving (or faltering). Finally, casting shareholder votes on important environmental, social, and governance matters allow our voices to be heard by management, ultimately effecting change for the good.

Examining ESG factors allows us to understand a company’s non-financial risk. Although traditional investment analysis does not take into account non-financial risk, we believe doing so can provide insight into a company’s financial performance. Interestingly, the G in Governance shows the highest correlation with financial performance. This should be of no surprise since effective corporate governance is vital to a company’s performance when viewed from a long-term perspective. When a company has a declining G over several quarters in a row, we see that as a big red flag.

As the demand for VBI increases around the world, Portola Creek is uniquely positioned to help investors align their portfolio with their personal values AND generate returns in their portfolio.

At Portola Creek, we are dedicated to research and education.

What is Impact Investing?

What is Impact Investing?

How we vote proxies to influence change at the corporate level

How we vote proxies to influence change at the corporate level

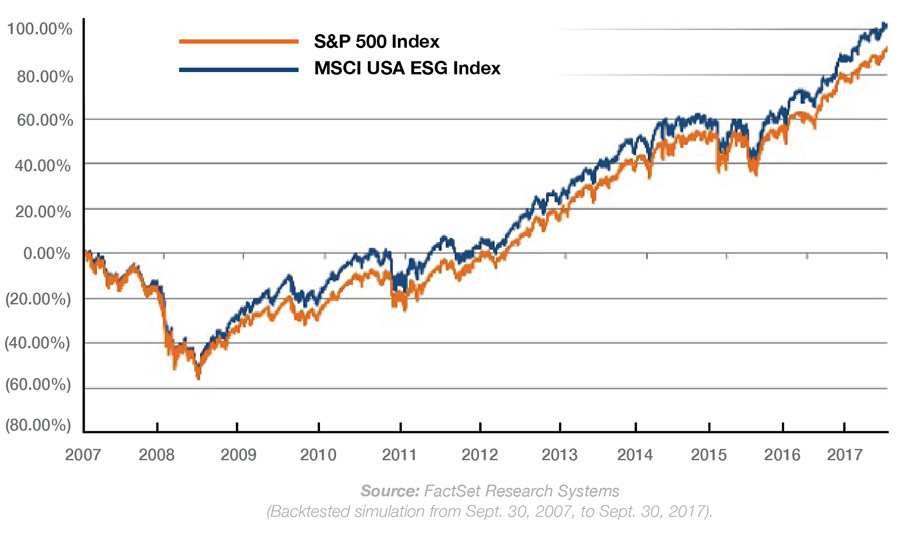

Values-Based Investing & Financial Performance

Values-Based Investing & Financial Performance

ESG - Environmentally-friendly subfactors

ESG - Environmentally-friendly subfactors

ESG - Socially-responsible subfactors

ESG - Socially-responsible subfactors

ESG - Corporate Governance subfactors

ESG - Corporate Governance subfactors

Portfolio Management - Our Investment Process and Portfolio Construction

Portfolio Management - Our Investment Process and Portfolio Construction

Subscribe for Portola Creek news, events and more.