How does a company’s operations contribute to governance issues?

Government factors in ESG criteria relate to good corporate governance such as the following board issues: transparency and accuracy, accountability and independence, as well as diversity and structure. Shareholder protection is another key issue in this area. Strong management is key to a successful company. Having good corporate governance in place sets a strong foundation for how a company operates. Of the three pillars of ESG, it seems G has the highest correlation to stock performance.

Case Study: Case Study: Tesla (TSLA)

Tesla announced in early 2018 the details of a new 10-year long-term incentive plan for its Chairman and CEO Elon Musk. The compensation plan is entirely performance-based, consisting exclusively of stock options and does not include any base salary, cash bonuses or time-based share grants. The 12 equal payouts will be based on ambitious milestones for market capitalization and operational metrics. The plan also includes a five-year holding requirement. While TSLA will continue to be a very volatile stock at this stage of the company, shares are up 10% in the first quarter of 2018, supporting our proposition that ESG investing reduces risk and enhances odds of profitability.

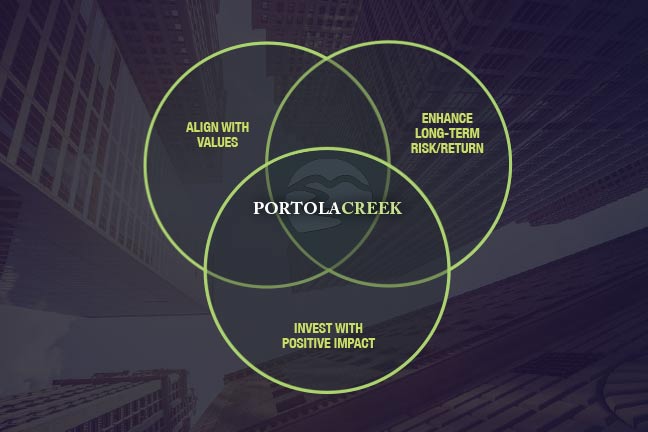

What is Impact Investing?

What is Impact Investing? How we vote proxies to influence change at the corporate level

How we vote proxies to influence change at the corporate level Values-Based Investing & Financial Performance

Values-Based Investing & Financial Performance ESG - Environmentally-friendly subfactors

ESG - Environmentally-friendly subfactors ESG - Socially-responsible subfactors

ESG - Socially-responsible subfactors ESG - Corporate Governance subfactors

ESG - Corporate Governance subfactors Portfolio Management - Our Investment Process and Portfolio Construction

Portfolio Management - Our Investment Process and Portfolio Construction